Some Known Details About Hsmb Advisory Llc

Some Known Details About Hsmb Advisory Llc

Blog Article

Get This Report on Hsmb Advisory Llc

Table of ContentsSee This Report about Hsmb Advisory LlcThe 15-Second Trick For Hsmb Advisory LlcThe Basic Principles Of Hsmb Advisory Llc The smart Trick of Hsmb Advisory Llc That Nobody is DiscussingExamine This Report on Hsmb Advisory LlcThe Single Strategy To Use For Hsmb Advisory Llc

Ford says to stay away from "cash money worth or permanent" life insurance policy, which is more of an investment than an insurance. "Those are extremely made complex, featured high commissions, and 9 out of 10 individuals do not require them. They're oversold since insurance policy agents make the biggest payments on these," he states.

Special needs insurance policy can be expensive. And for those that opt for lasting care insurance policy, this policy might make handicap insurance unnecessary.

The 6-Minute Rule for Hsmb Advisory Llc

If you have a persistent health problem, this sort of insurance could wind up being critical (Life Insurance St Petersburg, FL). Nonetheless, don't let it stress you or your savings account early in lifeit's typically best to obtain a policy in your 50s or 60s with the expectancy that you won't be utilizing it till your 70s or later on.

If you're a small-business owner, consider protecting your source of income by buying service insurance coverage. In the event of a disaster-related closure or duration of rebuilding, organization insurance can cover your revenue loss. Take into consideration if a substantial weather occasion influenced your store or production facilityhow would certainly that affect your revenue?

Plus, utilizing insurance might sometimes set you back even more than it conserves in the lengthy run. If you get a chip in your windscreen, you might consider covering the repair expenditure with your emergency situation cost savings instead of your auto insurance policy. St Petersburg, FL Health Insurance.

The Definitive Guide to Hsmb Advisory Llc

Share these tips to protect liked ones from being both underinsured and overinsuredand seek advice from a trusted specialist when required. (https://pubhtml5.com/homepage/cwkrs/)

Insurance coverage that is bought by a private for single-person coverage or protection of a family members. The specific pays the premium, as opposed to employer-based wellness insurance coverage where the company usually pays a share of the costs. Individuals might look for and acquisition insurance coverage from any kind of strategies offered in the person's geographic area.

Individuals and family members may certify for economic support to decrease the price of insurance costs and out-of-pocket costs, yet just when enlisting through Attach for Health Colorado. If you experience specific adjustments in your life,, you are eligible for a 60-day period of time where you can sign up in a private strategy, even if it is outside of the yearly open registration duration of Nov.

15.

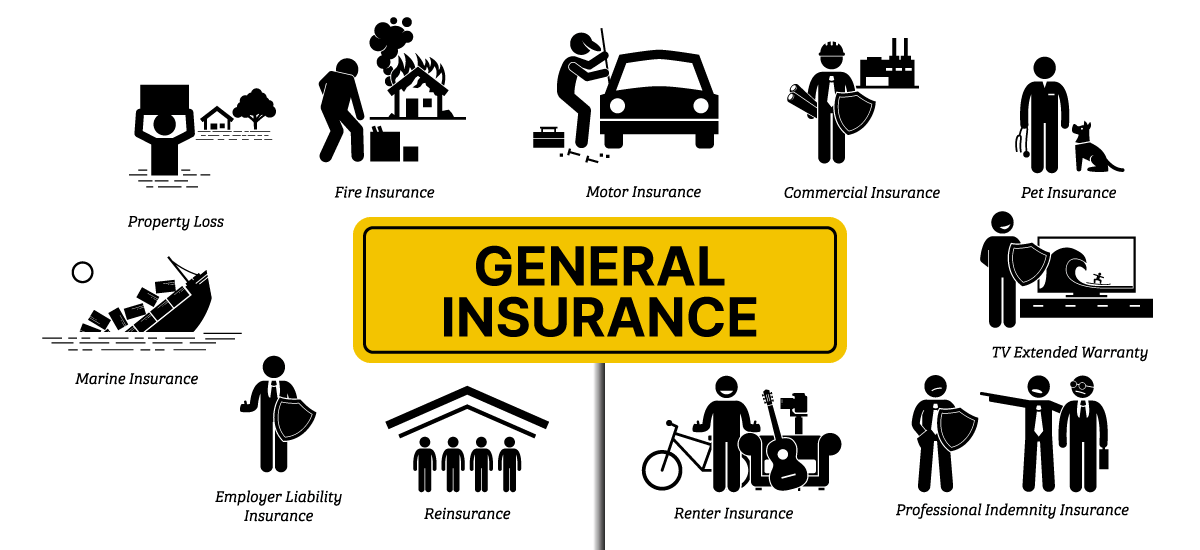

It may appear simple but recognizing insurance policy types can additionally be perplexing. Much of this complication comes from the insurance policy market's Click Here ongoing goal to design tailored coverage for policyholders. In developing flexible policies, there are a selection to choose fromand all of those insurance kinds can make it challenging to understand what a particular plan is and does.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

The ideal area to begin is to speak about the distinction in between both kinds of standard life insurance policy: term life insurance policy and permanent life insurance policy. Term life insurance is life insurance policy that is just active temporarily period. If you die throughout this duration, the individual or individuals you have actually named as recipients may obtain the cash payout of the policy.

Nevertheless, lots of term life insurance plans let you convert them to a whole life insurance coverage policy, so you do not shed coverage. Generally, term life insurance plan premium settlements (what you pay monthly or year into your policy) are not secured in at the time of purchase, so every 5 or ten years you own the policy, your premiums might increase.

They also have a tendency to be less costly general than entire life, unless you buy an entire life insurance policy plan when you're young. There are additionally a couple of variations on term life insurance. One, called group term life insurance, prevails amongst insurance policy alternatives you may have accessibility to via your company.

Getting The Hsmb Advisory Llc To Work

This is usually done at no cost to the staff member, with the capacity to acquire added protection that's obtained of the staff member's paycheck. Another variation that you may have accessibility to with your company is additional life insurance coverage (Life Insurance). Supplemental life insurance policy could consist of unintentional death and dismemberment (AD&D) insurance, or interment insuranceadditional coverage that could help your family in situation something unforeseen occurs to you.

Permanent life insurance policy simply refers to any type of life insurance policy that doesn't end.

Report this page